SAPs YE Results – Time for the 5X Pivot

Firstly, well done to Christian and the SAP leadership team, not only for delivering strong FY2025 results, but for steady, credible leadership through an exceptionally volatile global economic environment. That should not be understated.

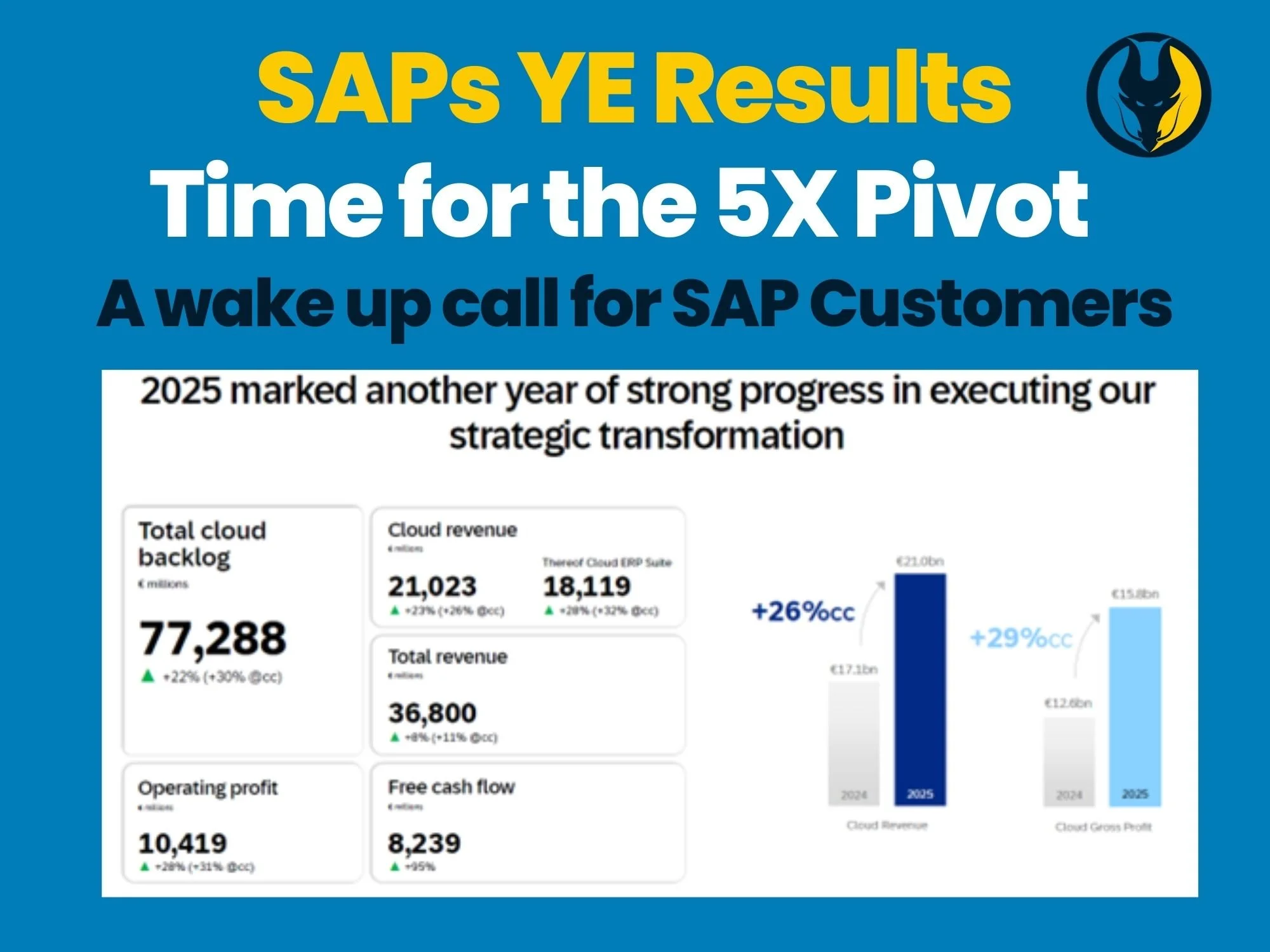

As we predicted, SAP largely nailed FY2025. Liquidity is improved, they need the cash to fund the new Sovereign Stack cloud, but the latest guidance and market reaction make one thing clear, the growth equation is changing. SAP’s leadership has historically been one step ahead, so expect the 5X pivot I have been blogging about for the last nine months.

From an investor perspective, FY2025 closed with strong cloud revenue growth and excellent cash generation. However, cloud backlog did not hit target, and guidance implies a modest deceleration into 2026. Q1 should be there or thereabouts, helped by the residue of late Q4 deal closures. Q2 will be the real test of underlying demand velocity.

This does not signal a demand cliff. It signals an expected pause and reflect moment from SAP’s very loyal customer base, with an expectation that SAP will, as always, read the room and step in and act. More on that below.

Current position (context):

Cloud revenue growth remains robust, but backlog growth has slowed

FY2026 cloud revenue guidance is broadly in line with consensus, not ahead of it

AI order intake momentum, not profitability, is now the key swing factor. I note a slight shift in emphasis at Davos away from Suite First as well

The strategic implication is clear:

To maintain momentum, SAP must now pivot hard toward monetising AI across the existing ECC and S/4 installed base.

Customers cannot, and will not, wait 12 to 18 months while brownfield S/4HANA programmes are planned and delivered. These programmes are 80% technical maintenance with a 20% functional tail, and customers want AI value now. If SAP cannot activate that value quickly, customers will look elsewhere. The agentic AI plug-and-play model is a real threat, as customers will not wait for the promise of embedded AI once rip-it-out-and-start-again programmes are complete.

It therefore follows that SAP needs to bridge the gap.

The strategic implication is clear:

To maintain momentum, SAP must now pivot hard toward monetising AI across the existing ECC and S/4 installed base.

Customers cannot, and will not, wait 12 to 18 months while brownfield S/4HANA programmes are planned and delivered. These programmes are 80% technical maintenance with a 20% functional tail, and customers want AI value now. If SAP cannot activate that value quickly, customers will look elsewhere. The agentic AI plug-and-play model is a real threat, as customers will not wait for the promise of embedded AI once rip-it-out-and-start-again programmes are complete.

S/4 Bridge.

A credible “S/4 Bridge”, enabling Joule deployment on ECC and partial S/4 landscapes, would allow customers to spin up custom, agentic AI on top of their existing digital core. That is where near-term revenue acceleration lives, not solely in transformation-driven cloud conversions.

The S/4 Bridge concept directly addresses SAP’s major 5X revenue generation risks:

Cloud backlog momentum

AI monetisation timing

Customer patience

Execution speed

Bottom line:

CFOs and CIOs, you hold all the cards. Now is the time SAP needs you to invest hard in AI and the Suite. The quid pro quo is customers moving their legacy ECC and BW estates to SAP Private Cloud. This creates a holding pattern through to 2033, enables immediate value from SAP’s safe-harbour sovereign stack, and allows SAP to drive AI revenue now. It is a win-win.

In the background, SAP will be working on S/4HANA PCE to make it more composable and agentic, so that by 2027 the path from ECC to S/4 becomes more wrap-around than migration. I genuinely do not believe many SAP customers will remain on ECC by 2030, but the landscape will be, as I have predicted, an omniverse of past, present, and future SAP solutions. That is the reality of tech singularity and the exponential rate of change.

Time for the pivot.

Need help shaping what’s next with SAP, or maximising your current SAP investment and assets? Message Alisdair

About the Author

Alisdair Bach is a recognised SAP Programme Director and turnaround specialist — often called a “turnaround king” by clients for his ability to stabilise and recover the most complex and failing SAP programmes. With decades of experience across global private equity and public sector portfolios, Alisdair has led high-stakes SAP S/4HANA transformations, finance and supply chain turnarounds, and complex delivery rescues.

Alisdair is also a SAP analyst working to define for investors where next with SAP, he is a author and lecturer, he defined the SAP upcycling concept as the alternate narrative to rip it out and start again clean core that is counter intuitive to AI adoption and SAPs 5X growth strategy.

Through Dragon ERP, he brings board-level assurance, forensic diagnostics, and hands-on leadership to programmes that others have written off — combining empathy with no-nonsense execution to deliver results where failure once seemed inevitable.